Top M&A - Q2 2025

Cybersecurity M&A surged in Q2 2025, with acquisitions dominating over mergers and strong investor focus on high-growth security sectors driving notable deals

Welcome back to Hall of Hacks Weekly!

The second quarter of 2025 saw a flurry of activity in the cybersecurity mergers and acquisitions (M&A) landscape, with a significant number of deals across a diverse range of security segments. The data reveals a clear preference for acquisitions over mergers and highlights a strong focus on specific, high-growth areas of the market. This report breaks down the key trends and the most notable deals from April to June.

First time seeing this?

Cybersecurity M&A Activity Heats Up in Q2 2025

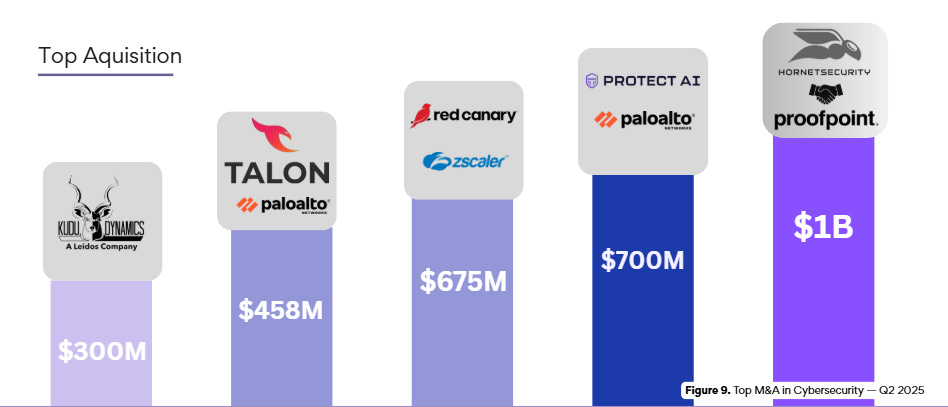

Top Acquisitions by Deal Value

Acquisition activity was robust, with several major deals driving significant investment. The most prominent deals, based on disclosed values, were concentrated in the high-stakes sectors of cloud security and threat detection.

Proofpoint's acquisition of Hornetsecurity: This was the largest disclosed deal, valued at $1 billion. This move solidifies Proofpoint's position in the cloud security space.

Palo Alto Networks' acquisition of Protect AI: A substantial deal at $700 million, aimed at bolstering its AI security capabilities.

Zscaler's acquisition of Red Canary: Valued at $675 million, this acquisition strengthens Zscaler's Managed Detection and Response (MDR) offerings.

Palo Alto Networks' acquisition of Talon: A $458 million acquisition to enhance its endpoint security portfolio.

Leidos' acquisition of Kudu Dynamics: A strategic $300 million deal focused on full spectrum cyber operations.

Key Segments That Attracted Capital

The data indicates that while M&A activity was widespread, certain segments were particularly hot, attracting the largest capital infusions through major deals with disclosed values.

Cloud Security & Data Protection: This combined category saw the most significant capital, driven by the $1.0 billion acquisition of Hornetsecurity by Proofpoint and the $270 million acquisition of Dropsuite by NinjaOne. As businesses continue their cloud migration, securing cloud environments and protecting data remains a top priority.

Application & Software Security: This segment also attracted considerable investment, with notable deals including Palo Alto Networks' $700 million acquisition of AI company Protect AI and Rubrik's acquisition of Predibase for over $100 million, highlighting the focus on securing software development and leveraging AI.

Threat Detection & Response: A consistently active segment, it saw substantial capital flow through high-value deals like Zscaler's $675 million acquisition of Red Canary, as well as the acquisitions of Apex Security ($105 million), Verity ($100 million), and Kudu Dynamics ($300 million). These deals underscore the ongoing demand for advanced threat intelligence and response capabilities.

Endpoint Security: This segment received a significant boost from the $458 million acquisition of Talon by Palo Alto Networks, signaling continued investment in endpoint protection.

Geographic Trends

The United States continues to be the epicenter of cybersecurity M&A activity, serving as both the home of the most acquired companies and the most active acquirers. Israel is also a prominent player, with several innovative companies being acquired by larger firms from both the U.S. and within Israel. The United Kingdom and Germany also saw notable activity.

Merger Activity

Mergers were less frequent in this period. The most prominent merger involved AdaCore (France/United States) and CodeSecure (India), combining to enhance their software security offerings. The merger of RestorePrivacy.com (United States) and CyberInsider (United Kingdom) also occurred to expand their digital privacy education reach.

Overall, the M&A landscape reflects a market maturing through consolidation. Larger firms are increasingly buying up specialized, innovative companies to expand their service portfolios and keep pace with evolving threats, a trend we expect to continue through the rest of the year.

📅 Coming Next Week

Stay tuned for our Q2 2025 Cyber Policies, where we will analyze the new regulations shaping cybersecurity’s global future.

Subscribe and Comment.

Copyright © 2025 CyberMaterial. All Rights Reserved.

Follow CyberMaterial on:

Substack, LinkedIn, Twitter, Reddit, Instagram, Facebook, YouTube, and Medium.