Top Investments - Q1 2025

Cybersecurity saw a record 142 investments in Q1 2025, with major funding in AI-driven threat detection, IAM, and data protection, signaling strong global investor confidence in cyber innovation.

Welcome back to Hall of Hacks Weekly!

In this week’s issue, we break down the record-setting investment trends that powered the cybersecurity sector in Q1 2025. From early-stage innovation to mega-rounds, investor confidence soared across multiple domains, highlighting where cyber defenses are evolving and where money is flowing.

First time seeing this?

🔐 Cybersecurity Investments in Q1 2025

Q1 2025 kicked off with a bang, with 142 disclosed investments, marking a highly active period for cyber-focused funding. From IPOs to seed rounds, the momentum highlights strong investor appetite across both emerging innovations and established platforms.

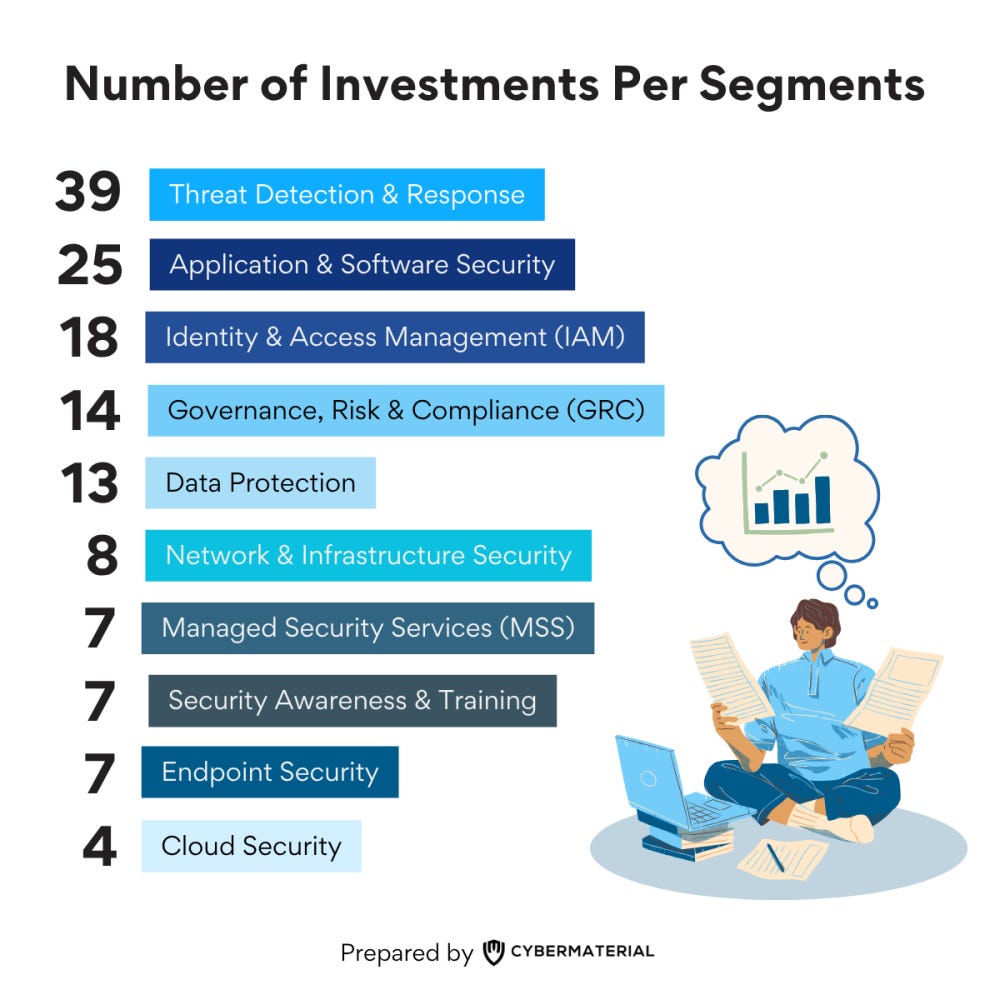

💰 Key Segments That Attracted Capital

Here’s a breakdown of where investors put their money in the first quarter, and what it signals for the future of cybersecurity:

Threat Detection & Response (39 deals)

The most active domain, with platforms tackling everything from AI-powered SOC automation to continuous pentesting and fraud prevention. Massive rounds for ReliaQuest, Tines, Cybereason, and SpecterOps confirm this segment as the most mission-critical.

Application & Software Security (25 deals)

Investors backed firms modernizing code security, AI-augmented application testing, and vulnerability remediation. Notable names included Semgrep, Moderne, and Straiker.

Identity & Access Management – IAM (18 deals)

Spearheaded by SailPoint’s $1.4B IPO and ID.me’s $275M debt round, this category remains foundational to zero-trust strategies and secure authentication frameworks.

Data Protection (13 deals)

Startups like QuSecure, TrustLogix, and Privy received critical backing to defend sensitive data across AI-driven and cloud-native environments.

Governance, Risk & Compliance – GRC (14 deals)

Solutions focused on compliance automation and fraud detection gained traction, with companies like Sardine, Delve, and Opaque Systems leading the charge.

Network & Infrastructure Security (8 deals)

Funding went to companies securing core connectivity and physical infrastructure, including OT/ICS systems and quantum-resistant technologies.

Security Awareness & Training (7 deals)

Platforms like Riot and Anagram helped reinforce the human layer of defense through AI-enhanced simulations and real-time training tools.

Endpoint Security (7 deals)

With endpoint threats rising, investments in Island, NinjaOne, and Cybereason aim to modernize and scale endpoint resilience across sectors.

Cloud Security (4 deals)

Although smaller in volume, this segment saw strategic activity addressing SaaS posture, cloud workload protection, and cross-cloud governance.

💼 Notable Funding Rounds

Some standout rounds that made headlines:

SailPoint raised $1.4B in an IPO (IAM) – the largest round of the quarter.

ReliaQuest secured $500M in Private Equity (Threat Detection & Response).

NinjaOne raised $500M in Series C Extension (Endpoint Security).

ID.me landed $275M in Debt Financing (IAM).

Island closed $250M in Series E (Endpoint Security), bringing its valuation to $ 4.8B

🌍 Geographic Distribution

Investors: Primarily U.S.-based, with strong representation from California, New York, and Massachusetts. Notable international players included funds from Israel, Germany, France, Singapore, India, and the UK.

Investees: While the U.S. remains the epicenter for cyber startups, funding also flowed to companies in Israel, Spain, Finland, Australia, and Canada, showcasing cybersecurity’s expanding global footprint.

🔎 Why These Investments Matter

Q1’s explosion in funding underscores several critical themes shaping 2025:

AI-first security is in high demand.

Agentic AI platforms are becoming standard in SOCs, pentesting, and endpoint protection.

Zero-trust identity and access solutions are scaling.

IAM continues to attract large-scale investment due to rising remote access and identity fraud risks.

Data protection and compliance are no longer backend concerns.

These domains are becoming integrated into product strategies, especially in SaaS and cloud-native operations.

Whether it’s defending against deepfakes, protecting LLMs, or securing connected vehicles, the future of cybersecurity is intelligence-led, highly automated, and globally scaled.

Coming Next Week

We’ll break down the Top M&A Deals of Q1 2025, spotlighting the most strategic acquisitions and exits reshaping the cyber landscape. From unicorn exits to MSSP consolidations, learn how big players are positioning themselves for the AI-powered decade.

Subscribe and Comment.

Copyright © 2025 CyberMaterial. All Rights Reserved.

Follow CyberMaterial on:

Substack, LinkedIn, Twitter, Reddit, Instagram, Facebook, YouTube, and Medium.